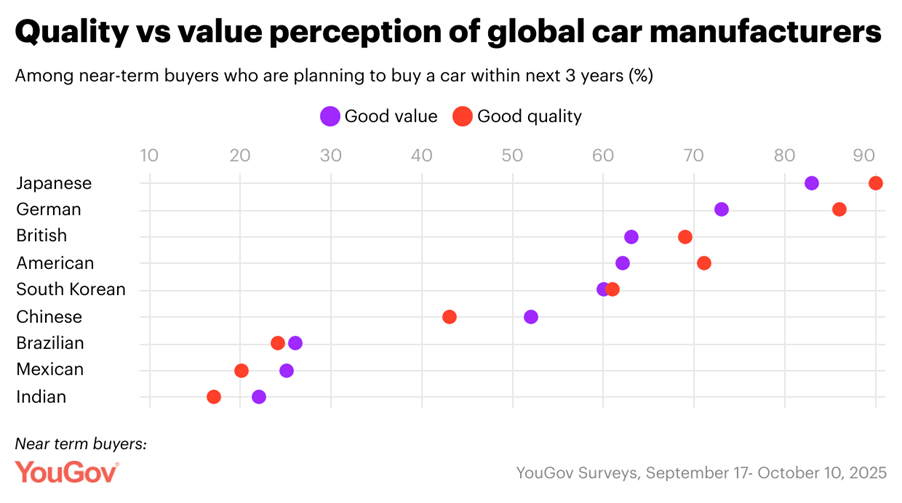

Japanese car manufacturers continue to hold a strong lead in the Indonesian automotive market, with consumers rating them highest in both quality and value, according to YouGov’s “Indonesia Next-Gen Car Outlook 2025” report. The survey found that 90% of Indonesians consider Japanese brands to be of good quality, while 83% say they offer strong value for money. German brands follow in second place, while British, American and South Korean automakers sit in the mid-tier of consumer perception.

The report also highlights robust buying momentum. Around 43% of Indonesians plan to purchase a car within the next three years, including 17% who intend to buy within the next 12 months. Petrol-powered vehicles remain the top choice (49%), although interest in hybrid (21%) and electric cars (12%) continues to grow.

Market Shift as New Players Gain Visibility

Despite Japan’s continued dominance, the automotive landscape in Indonesia is undergoing a transition. The study shows that 81% of Indonesians can now name at least one emerging car brand, with Wuling leading brand awareness at 55%, followed by BYD (39%), Chery (22%) and BYD Denza (17%). However, recognition drops significantly for other new entrants, indicating early differentiation stages among lesser-known brands.

Awareness is even higher among near-term buyers—those planning to purchase a car within three years—suggesting that emerging brands are gaining traction among active shoppers.

Indonesians Increasingly Open to New Car Brands

The report further reveals growing openness toward new automotive players. Overall, 58% of Indonesians say they are willing to buy from a new or emerging brand, rising sharply to 76% among those who plan to purchase soon.

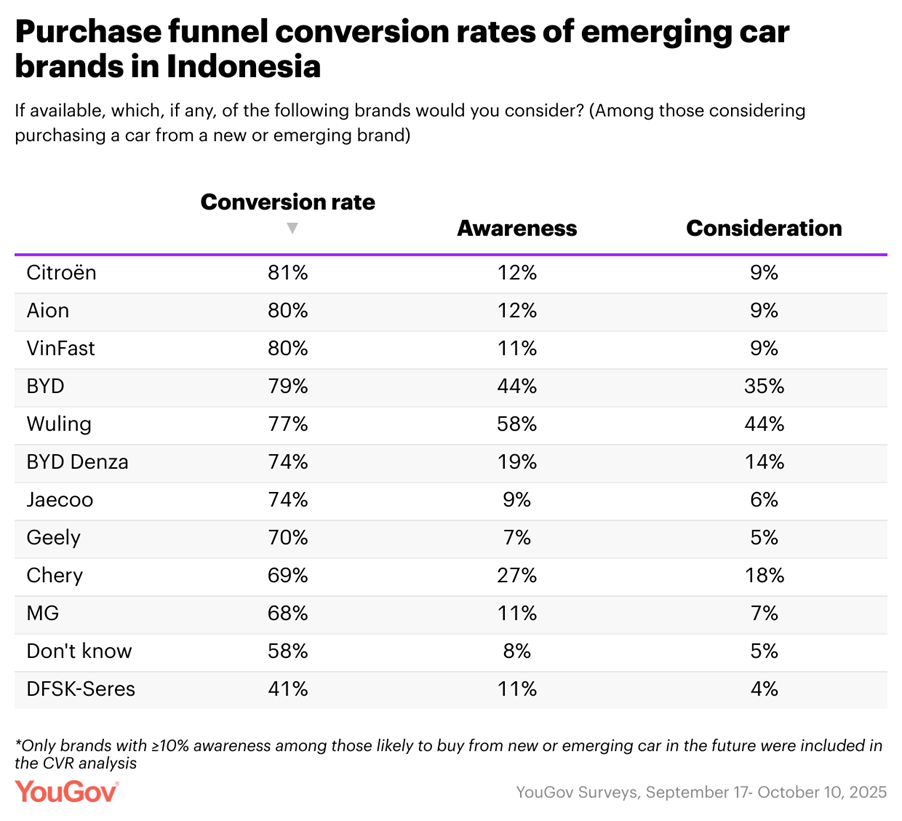

YouGov also analyzed conversion rates from brand awareness to purchase consideration. Citroën leads the pack with an 81% conversion rate, followed closely by Aion (80%) and VinFast (80%). Although Wuling enjoys the highest awareness level, its conversion rate sits at 77%, showing that visibility does not always directly translate into consumer consideration.

Drivers and Barriers to Adoption

For Indonesians familiar with emerging brands, the main factors driving interest include fuel efficiency (57%), advanced technology (52%), safety features (46%), and sustainability (46%).

However, concerns remain. Cost is the biggest barrier (50%), followed by resale value (47%), technology shortcomings (42%), and reliability issues (39%). The report notes gender differences as well: men are more likely than women to be concerned about cost and resale value.

Trust Gap Still a Challenge

Overall, the findings point to a growing curiosity among Indonesians toward new entrants in the automotive market. However, YouGov notes that a “trust gap” continues to hinder conversion from interest to actual purchase. To compete more effectively, emerging brands must strengthen perceptions of reliability, long-term value and technological quality.